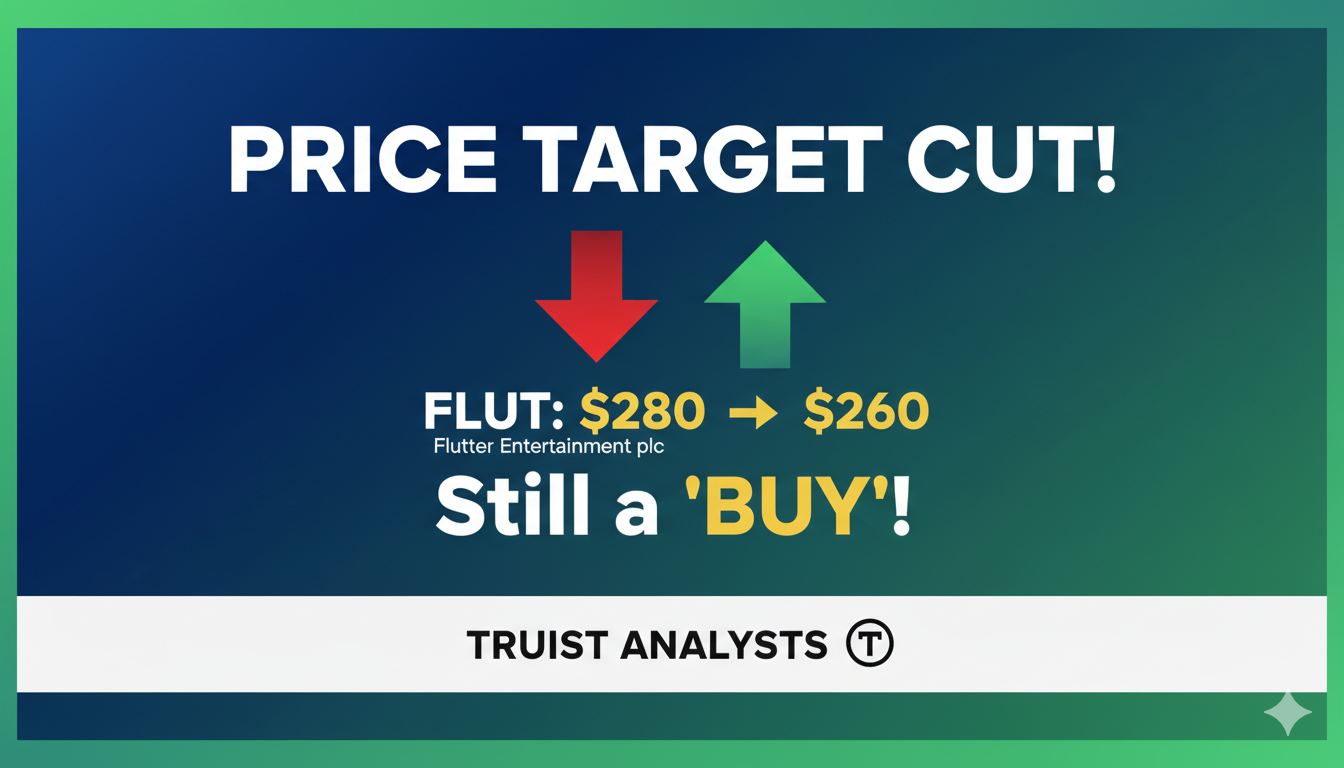

Truist analysts have reduced the price target for Flutter Entertainment plc from $280 to $260 while reaffirming a ‘Buy’ rating, citing macroeconomic headwinds, market recovery uncertainties, and regulatory tax hikes impacting future earnings; the stock recently closed at $188.46, down over 6%, near its 52-week low.

Analyst Perspective Truist Securities has revised its outlook on Flutter Entertainment plc, the parent company of FanDuel and other global betting platforms, by trimming the 12-month price target to $260 from the previous $280 level. Despite the cut, the firm continues to endorse a ‘Buy’ recommendation, signaling confidence in the company’s long-term growth potential within the competitive sports betting and online gaming landscape. The adjustment reflects a tactical reassessment of near-term catalysts, including persistent macroeconomic pressures that have weighed on consumer spending in discretionary sectors like gambling. Analysts highlighted fears of prediction disruptions from external events and ongoing uncertainties surrounding the recovery of key markets such as Las Vegas, where physical casino operations have faced slower-than-expected rebound amid economic volatility.

Recent Stock Performance Flutter Entertainment’s shares have experienced significant downward pressure in recent trading sessions, closing at $188.46 after a 6.28% decline in a single day on elevated volume of over 3.1 million shares. This places the stock near its 52-week low of $187.95, a stark contrast to its high of $313.69 within the same period. The current bid-ask spread hovers around $186.97 to $188.84, indicating continued market hesitation. Year-to-date, the stock has underperformed broader indices, with a cumulative drop exceeding 20%, driven by sector-wide concerns over profitability in an environment of rising operational costs and shifting consumer behaviors.

| Key Stock Metrics | Value |

|---|---|

| Current Price (Close) | $188.46 |

| 52-Week High | $313.69 |

| 52-Week Low | $187.95 |

| Market Capitalization | Approximately $33.5 billion |

| Average Daily Volume | 1.2 million shares |

| P/E Ratio (Trailing) | 45.2 |

| Dividend Yield | 0% (No dividends paid) |

Regulatory and Operational Headwinds A major factor influencing the revised target stems from recent tax policy changes in key jurisdictions. In the UK, where Flutter derives substantial revenue through its UK and Ireland segment, the government has implemented steep increases in gaming duties. Online gaming taxes have risen from 21% to 40%, while sports betting duties climbed from 15% to 25%. These hikes are projected to erode adjusted EBITDA by roughly $320 million in fiscal 2026 and $540 million in 2027, before any internal mitigation strategies such as cost optimizations or pricing adjustments. Similar regulatory scrutiny in other markets, including Australia and international operations, adds layers of complexity, potentially constraining expansion efforts in emerging online betting regions.

Broader Sector Context and Peer Comparisons The price target reduction aligns with a wave of cautious analyst sentiment across the U.S. gaming industry, where operators face intensified competition from new entrants and digital platforms. However, not all views are pessimistic; for instance, Citizens JMP recently lifted its target on Flutter to $313 from $311, maintaining an ‘Outperform’ rating and emphasizing the stock’s undervaluation relative to historical averages. Consensus among analysts polled remains bullish overall, with an average price target of $294.73 and a predominant ‘Buy’ or equivalent rating. Compared to peers like DraftKings and MGM Resorts, Flutter’s U.S. arm, FanDuel, holds a leading market share in mobile sports wagering, bolstered by strategic acquisitions and technology investments, though profitability margins have been squeezed by promotional spending to capture user growth.

Key Investment Considerations

Growth Drivers: Strong positioning in the U.S. market via FanDuel, with potential upside from legalized betting expansions in additional states.

Risk Factors: Exposure to regulatory changes and economic slowdowns that could dampen user engagement and revenue per player.

Valuation Insights: At current levels, the stock trades at a forward P/E multiple below sector peers, suggesting room for appreciation if earnings stabilize amid improved game outcomes and cost controls.

Institutional Activity: Recent filings show increased holdings by major investors, such as a 2.4% stake expansion by Massachusetts Financial Services, indicating sustained interest despite short-term volatility.

Disclaimer: This news report is for informational purposes only and does not constitute investment advice or tips. Sources are based on publicly available information.